Autonomous Freight Procurement Eliminates Waste & Bias

Autonomous Freight Procurement is revolutionizing the transportation industry by eliminating waste and bias from critical over-the-road transportation management decisions. Many shippers, who have prioritized supply chain digitization, have embraced technological advancements and are actively uncovering resilience, sustainability, and cost reduction opportunities they never knew they had. What is Autonomous Freight Procurement? Autonomous Freight Procurement involves leveraging advanced technologies, such as artificial intelligence (AI), to automate the manual processes of finding compliant carriers, negotiating rates and terms, coordinating shipments, and managing invoicing. The primary goal is to streamline the logistics process, increase efficiency, and reduce costs. What are Autonomous Freight Procurement benefits? The benefits of Autonomous Freight Procurement are significant. First, it increases efficiency by reducing or eliminating manual, repetitive, and time-consuming tasks. Second, it always chooses the most cost-effective carriers, which reduces truckload costs. Third, it always selects the most reliable and compliant carriers, which improves on-time delivery and overall customer experience. Finally, it provides 100% data transparency, empowering shippers to make stronger, data-informed decisions. Overall, Autonomous Freight Procurement is a powerful tool for optimizing logistics operations and improving the bottom line. By leveraging advanced technologies such as autonomous freight procurement software, shippers can stay competitive in today's fast-paced business environment and deliver the best possible service to their customers.

Eliminate Costly Transportation Decisions By Closing The Data Gap

Imagine having to optimize something without having all the facts and data. This is what transportation/ logistics professionals are forced to do all the time. Unfortunately, many shippers don't have actionable data and rely heavily on historical benchmarks or market averages when making crucial transportation decisions. This approach leads to implications that could impact a large company's financial health by millions of dollars. Several issues can be solved by closing the freight procurement data gap, such as selecting the best possible carrier for each run, and level-setting truckload prices. Poor Carrier Selection Many shippers continue to use the same roster of carriers, even when far better options are available because they lack actionable insights to identify existing problem areas. It’s like the old saying… You can’t fix what you don’t know is broken. Without complete and accurate carrier performance and pricing data, shippers can’t make informed data-driven decisions about which carriers to keep, drop or add. This leads to suboptimal carrier selection, higher transportation costs, and poor service levels which lead to unhappy customers. Not Understanding Truckload Price When working with freight brokers, shippers are presented with a non-transparent truckload cost, with no insight into how payments are divided between brokers and trucks/carriers. To truly comprehend the real truckload cost, it's crucial to obtain pricing directly from the truck/carrier without any hidden middlemen fees. Incomplete data puts shippers at a massive disadvantage and falls short of providing the insights necessary to level-set or standardize truckload pricing across the entire carrier network. Overpayment leads to millions of dollars in transportation budget overages, and underpayment leads to poor service levels and late...

How to Guarantee You Always Pay a Fair Truckload Price

The one thing all truckload shippers want to know, in order to deliver goods on time while paying a fair market price, is who are the most efficient and cost-effective carriers for each load. Unfortunately, shippers find it hard to answer this burning question because there are massive data gaps due to a lack of data transparency. For example, shippers who still rely on brokers to haul freight, never know what the truck is paid. They can only assume that the broker is taking some % markup. This makes it difficult to know what the true truckload market cost is at that moment in time so proper optimizations can be made. Technology startups have entered the marketplace to close these data gaps and help shippers make informed real-time decisions. For example, AI-powered automation software dynamically finds and vets compliant carriers, and then has carriers bid directly on the load. Shippers gain full visibility on what the truck wants to get paid to help level-set pricing across the entire carrier network while strengthening service levels. Advanced freight procurement data, with 100% data transparency, makes it possible to know which carriers to keep, add or drop so the shipper is always in the know and can rest assured they are paying the right price. Gone are the days where logistics teams spend hours trying to source a compliant carrier, or where important decisions are made based on gut and intuition. With today’s unprecedented disruption, shippers need dynamic, real-time tools that support quick pivots especially as freight market conditions fluctuate. Implementing software, especially technology that seamlessly plugs directly into existing platforms, provides an...

How Continuous Improvement Mindset Has Supercharged Freight Procurement

In today's rapidly changing business environment, organizations are looking for ways to stay competitive and maintain their edge. One crucial area that can significantly impact the bottom line is freight procurement. By embracing a continuous improvement mindset, shippers can supercharge their transportation efforts, reduce truckload cost, and strengthen customer service/ satisfaction. This blog will explore the reasons why continuous improvement is essential in the world of freight procurement and how it can lead to tangible benefits. Freight Procurement Has Remained Unchallenged and Therefore Unchanged Before we dive in, it is important for continuous improvement professionals to understand that the freight procurement process has remained unchallenged, and therefore unchanged due to a lack of technological advancements, and a lack of data transparency amongst third-party logistics partners [3PLs]. It is also important to understand the freight procurement process step-by-step. A typical freight procurement process involves selecting and contracting carriers to transport goods from one location to another at the best cost, service quality, and reliability. The process from start to finish is a long one. Massive amounts of time and energy are expelled at every step, especially when done manually. Steps include, but are not limited to: Defining shipment requirements. Finding carriers. Requesting pricing or tender. Analyzing quotes. Negotiating rates and terms. Awarding loads. Preparing shipping documentation. Monitoring and tracking shipments. Inspecting and verifying shipments. Evaluating carrier performance. How Continuous Improvement Benefits Freight Procurement When the freight procurement process is fully optimized, shippers receive many benefits. Streamlined Processes and Operational Efficiency: A continuous improvement mindset encourages shippers to continuously review and optimize critical supply chain processes to eliminate inefficiencies, redundancies, and bottlenecks....

Q2 Freight Market Update & How Innovative Shippers Have Prepared!

As the Q2 freight market update states, supply (# of carriers) will continue to surpass demand (# of loads). That said, there are plausible scenarios that could help balance supply and demand, tightening market conditions, sooner than anticipated. Possible Q2 freight market fluctuation The freight market is similar to the stock market. Supply (# of carriers) and demand (# of loads) determine truckload cost. The balance between supply and demand can change at any moment due to a variety of factors, including but not limited to the economy and seasonality. For Q2, higher fuel cost and inflation, increased regulation, and overcapacity will continue to push smaller, owner-operator carriers out of business. As trucks idle, supply will decrease because there will be fewer trucks available to move goods. At the same time, demand can increase due to increased seasonal production spikes in produce and building/construction. As noted above, when the balance between supply and demand changes, so should truckload pricing. How Shippers Can Proactively Prepare for Marketing Fluctuation When there’s excess supply (carriers) and rates fall, trucking companies exit the market. When rates rise, new trucking companies enter the market until carrier saturation occurs and rates fall back down again. It’s a vicious cycle. “The key for shippers is to find ways to dynamically stay on top of freight market twists and to pivot quickly with little notice. Remaining static is not sustainable because freight supply and demand always changes,” said Oleg Yanchyk, Sleek Technologies CIO. Forward-thinking shippers have replaced legacy freight procurement processes, such as RFPs, brokers, and spot quoting with AI-powered software so there are no delays when reacting...

Top Tips To Quickly Fill Gaps When Transportation Teams Are Burned Out.

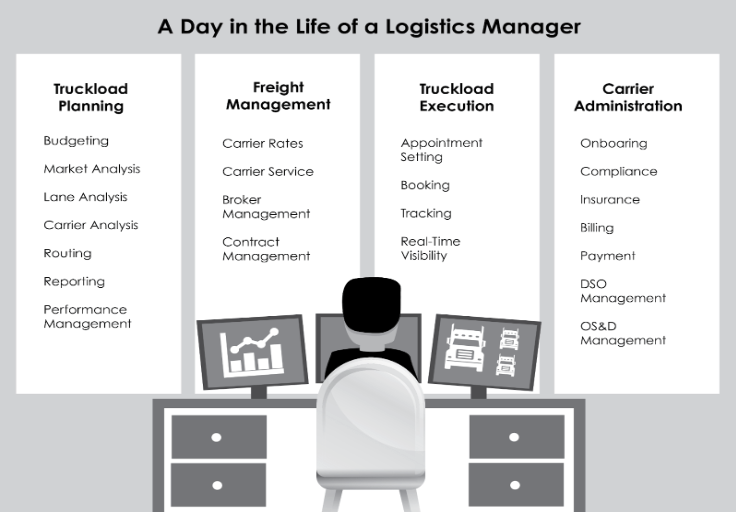

Transportation teams are burned out! Studies have revealed that over 15% of transport and logistics workers are contemplating leaving their job due to excessive stress. Why? Most teams have heavy lifts, are understaffed, and lack the proper tools to successfully perform their job. Specifically, they need c-suite acknowledgment, actionable data, and smart technology to achieve their goal which is to deliver goods on time, at a fair market price. US Domestic Truckload Supply Chain Teams Feel Like They’re Running On Treadmills And Getting Nowhere. Truth said, there are not enough hours in the day for transportation/ logistics managers to deal with day-to-day requirements, fire drills, and strategic initiatives. They have many tasks including, but not limited to, transportation planning, procurement, dispatching, routing, tracking, and invoicing. Freight procurement alone is a full-time job. Hours are spent finding and then vetting new carriers for safety and compliance. After a carrier has been approved, more time and energy are spent onboarding the new carrier. As more carriers are added to the network, there are more vendor relationships that need to be juggled and managed. “US Domestic Truckload Supply Chain teams have a heavy lift and are short-handed,” said Michael Paul, VP of Sleek Technologies Sales. “Week after week, shippers tell me they're trying to juggle a number of activities that leaves them feeling like they're on a treadmill and not getting anywhere. They are so focused on annual bids, dealing with fire drills, and being short-staffed that they feel like they don't have time to look at innovative solutions.” Unfortunately, these problems are compounded when the team is down a resource due to...

Tips to Create ‘Win-Win’ Partnerships For Long-Term Transportation Success

Freight Market Fluctuation It’s a shipper’s market. Truckload cost has decreased, and shippers are level-setting pricing with their providers. But sometimes, especially when the c-suite has demanded operational cost reductions, shippers push too hard chasing the lowest-priced providers, which can push long-term providers to the side. They lose sight of the bigger picture, and often-times forget about longer-term ramifications until it’s too late. “Focusing 100% on truckload cost may reduce a shipper’s transportation budget in the short term, but opens the shipper up for more risk especially when the freight market snaps back,” said Dean Corbolotti, VP Managed Services at Sleek Technologies. “The long-term approach should be to build win-win solutions that result in both the shipper and the provider reaping benefits year-round, as opposed to one side always winning.” But what happens when it is a carrier market; a tight freight market? Some providers chase the highest-priced loads and charge excessive amounts for their equipment to make as much money as possible. Again, this is a short-sighted strategy as only one party wins. Unfortunately, shippers and carriers take advantage of the cyclical freight market to help cover losses when the other party was winning. 'Win-Win' Shipper/Provider Strategy The only solution that supports long-term partnership relationships is a Win-Win solution. This is when both the shipper and provider work together so both parties win. A Win-Win relationship is built on trust. Here are three things that need to occur to support a Win-Win strategy: 100% data sharing (no more secrets or hidden margins). Charging/paying a fair market price (truckload price fluctuates with supply & demand). Staying the course during extreme...

Why I Left Freight Brokerage for Tech Start-Up!

Working as a successful freight broker, for over a decade, most of my days were spent wheeling and dealing over the phone or via email finding trucks to haul loads. My compensation was based on how much spread or margin I negotiated per load. The truth is, to be successful, most brokers focus on moving loads with the biggest margin. Oftentimes, different customers ship loads using the same lane multiple times per day. For example, many customers use Chicago to Memphis. Customer A is locked in at $2,000, while Customer B locks in at $1,000. As a broker, I know that carriers would accept Chicago to Memphis for $900. Therefore, my attention, like most brokers, would be focused on matching a carrier to Customer A’s load, which means more profit for my brokerage, and my own pocket! Customer A: pays $2,000 and carrier charges $900= $1,100 spread Customer B: pays $1,000; carrier charges $900= $100 spread Unfortunately, neither customer A nor B knows what the market demands which means they are either overpaying to haul the freight or in some cases under paying to haul freight which usually leads to horrible service levels. Without data transparency, shippers never know the true market cost or what carriers demand to haul loads. And this is exactly what brokers want to happen to remain profitable. Re-Inventing Freight Procurement But as supply chains began to embrace technological advancements, specifically AI and automation, I realized that machine learning could find, vet, and transact with carriers much faster than I ever could. That’s when it finally occurred to me that I could soon be out of...